By 2032, Jersey City could face a housing shortage between 27,000 and 36,500 units, representing 20% to 27% of the current housing stock.

Map by RPA using Council District and Ward boundaries from Jersey City Open Data Portal and Building Footprint data by Microsoft Maps

In the last decade, Jersey City experienced a construction boom that increased the housing stock by almost a quarter and largely transformed the city’s skyline. The city is also one of majority renters - 39,000 units (30%) are owner-occupied, and 91,000 are renter-occupied.

Despite its rapidly growing housing supply, city residents struggle to find housing they can afford. 39% of all households are burdened by housing costs, meaning more than 30% of annual income goes toward rent or mortgage payments. Lower-income households are also disproportionately affected, with 60% falling into this category. Housing cost burdens are less severe in Jersey City than in New Jersey as a whole, likely due to higher incomes and smaller household sizes, but the growing imbalance between new housing stock and households being formed (population growth coupled with household size) keeps vacancies in Jersey City low, severely limiting options for relocating into or within the city.

Between 2010 and 2022 alone, Jersey City added almost 26,000 units to its housing stock, representing 24% growth in housing units. This is more than triple the per capita production observed in the larger metropolitan area. According to the Jersey City Division of Planning, another 14,000 units have been approved or are under construction.

In addition to market forces at play, Jersey City has taken several steps to facilitate this production. In 2013, the city implemented a tiered tax abatement policy, and in 2015, the city prepared its first comprehensive city‐wide housing plan. More recently, Jersey City passed an inclusionary zoning ordinance in 2021, which requires certain developments to provide 10-15% of the units as affordable when the developer requests more than four additional units or an additional 5,000 square feet of residential floor area through a redevelopment plan amendment or variance, now allows for accessory dwelling units (ADUs), and it developed a new consolidated affordable housing portal.

Vacancy rates decline if the housing supply does not adjust in proportion to changes in housing demand. Despite new housing production, even higher demand has resulted in low vacancies, driving costs upward. This significant decrease in the percentage of housing units available to rent or buy has resulted in a tighter market with fewer options for tenants and prospective owners.

Housing Production & Household Formation

Between 2010-2022, household formation (demand) outpaced new housing development (supply) by 17%. Vacancy rates were reduced by 11.2%.

American Community Survey 1 Year Estimates Selected Housing Characteristics Table DP04

Jersey City is home to a population of 286,661 residents. The median household income in Jersey City is $94,000, slightly below the New Jersey statewide average of $96,346. Its bustling downtown, racial diversity, and strategic location just a few minutes from New York City make it an attractive place to live and work.

Mobility

Jersey City is well connected to both New York City’s Central Business District to the east and New Jersey communities to the west. Residents benefit from easy access to major employment, education, and cultural centers within the city and surrounding areas through a range of transportation options, including a robust road network, PATH train, Hudson-Bergen Light Rail, NJ Transit buses, and ferries. While there are no New Jersey Transit (NJT) heavy rail stations within the city boundaries, Hoboken terminal and Newark Penn are adjacent and can be reached via the light rail, PATH, walking, or biking. This comprehensive transportation network provides intra-city connectivity and supports efficient travel, cementing Jersey City’s importance at the local and regional level.

Understanding the modes of transportation used for commuting is helpful for evaluating accessibility and gauging travel patterns across Jersey City. The percentage of workers by commute mode is 36% transit, 5% walk, and 3% bike, compared with 26% driving alone and 6% carpooling. A quarter of Jersey City residents reported working from home, likely reflecting new hybrid and virtual work modes since the COVID-19 pandemic. The breakdown underscores the need to maintain walkable neighborhoods and expand transit systems that most of Jersey City’s workers depend on and use to access the largest metropolitan job market in the country.

Land Use

Land use is crucial for understanding the residential composition and development patterns of the city. Jersey City has approximately 50,000 total parcels, 71% of which are residential. Of that total, 25,000 single-family lots (50%) and 10,500 multi-family lots (21%) shape the city’s general landscape.

Surface area in acreage offers another perspective of the residential composition of Jersey City. Analysis of the 7,800 acres of total upland area revealed that residential lots occupy just 23% (approximately 1,750 acres), with single-family lots covering 19% and multifamily lots just 4%. Almost a third of the city’s land area (32% or 2,300 acres) is devoted to commercial and industrial uses. Another 45% of the land (3,500 acres) is devoted to open space, cemeteries, civic institutions, and other uses.

Building and Unit Size

Reviewing the change of building types is crucial for understanding density and assessing the proportion of residents living in single-family homes versus dense multi-family apartments. The type of building stock, including building and unit size (number of bedrooms), can also influence household composition and formation rates in a city or region.

While most of the city’s housing units are located in multifamily buildings (86%), these occupy just 5% of the land area. Single-family buildings on the other hand, occupy almost 1,500 acres or 23% of land area, yet only represent 14% of the total stock (19,000 units).

Between 2010 and 2022, the city added 26,000 units, out of which 19,200 units (73% of the new stock) have come in the form of large multifamily buildings, each with 20 units or more. During the same time, moderately sized multifamily buildings with 5 to 9 units grew by another 3,800 units (14% of new stock). All other building types, including single-family, remained stable or grew by small margins. In addition, the change in housing units by number of bedrooms during the same period shows that 13,500 units, representing 51% of total new stock, came in the form of 1-bedroom apartments, partly explaining the shrinking size of households further discussed below.

Demographics

In Jersey City, Asians and Hispanics/Latinos of any race make up a slight majority of the population. Although all racial and ethnic groups are well represented, the city exhibits signs of spatial clustering or segregation by neighborhood, meaning that similar groups of people tend to live near each other.

Housing needs tend to change over the course of the lifecycle of individuals and families. When considering what makes a thriving, inclusive community, the housing needs of people of all ages and incomes are critical factors. Younger households tend to seek smaller, often rental, housing, while growing families often seek larger homes, both rental and ownership. Between 2010 and 2022, the average household size shrank from 2.54 to 2.06. The shrinking size of households is partly driven by a broader national trend where marriage and birth rates among the young population are declining. In addition, the type of new units built since 2010, mostly in the form of single bedrooms, has further contributed to Jersey City’s shrinking household size.

The decrease in household size is also interrelated with the overall reduction of children and younger adults. Between 2010 and 2022, the city saw a decrease in 4,900 children under the age of nine, 4,500 fewer teenagers between 15-19 years, and 2,300 fewer adults between 20-24 years. Making up for the reduction in children and teenagers, Jersey City’s population in the age groups of 25 to 44 years - where labor force participation is highest - increased by 25,500 during the same time period. In 2022, the population in this age bracket represented 41% of the total, an increase from 37% in 2010.

Year Built

Substantial housing stock has been completed relatively recently, with almost a third of residential buildings being built in the 21st century. Of the entire housing stock, 42,000 units (31%) were built in the last 24 years, 50,000 units (38%) were constructed post-WWII through the turn of the century, and 42,000 units (31%) were built pre-WWII.

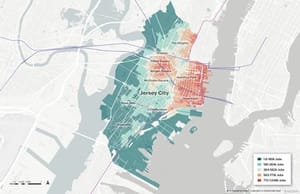

Most of the housing units built since 2010 have been concentrated in areas with good transit access to employment opportunities, primarily around Journal Square, Grove Street, and Newport Path Stations. Housing in transit-oriented areas has numerous benefits, including increasing walkability and lowering carbon emissions.

Flood Loss

Hurricane Sandy severely impacted Jersey City in 2012, but climate change impacts will continue to worsen with time. Projections for a 33-inch sea level rise suggest that as many as 4,223 housing units, most of them near the Hudson and Hackensack Rivers, could be permanently inundated or lost by the year 2070. 3,422 or 81% of the units most at risk of being lost to permanent flooding are in multifamily buildings; the remaining 800 units at risk are in single-family buildings. It’s important to note that this estimate considers only sea level rise and does not account for potential flood damage from sudden extreme rainstorms.

Median Household Income

The median household income in Jersey City is $94,000, compared to the state average of $96,346. 9.5% of families and 12.8% of individuals live below the federal poverty level, which for New Jersey in 2022 was $27,750 for a family of four. Jersey City also exhibits a clear divide between wealthy and lower-income neighborhoods, with wealthier areas clustered near the Hudson waterfront and lower-income neighborhoods concentrated around the Communipaw and Journal Square neighborhoods. This income distribution reflects disparities by race and ethnicity, underscoring the socioeconomic challenges faced by certain communities.

Furthermore, such disparities are also reflected on housing tenure (owners and renters). Over 78% of Jersey City households earning below the median income are renters. For those in the lowest income bracket, that rate increases to 88%. Only 22% of households below the median are homeowners.

The HUD-adjusted Area Median Family Income (HAMFI) is very similar to the more commonly used“Area Median Income (AMI).” Essentially, it is a way of comparing household incomes within a region regardless of household size. To put this figure into context, 100% HAMFI is $94,000. Income >30% to <=50% HAMFI is $28,200 to $47,000, or the median salary of a customer service representative or a medical assistant. Income >50% to <=80% HAMFI is $47,000 to $75,000, or the median salary of a school bus driver or mail carrier, and the starting salary for teachers in the Jersey City Public School District.

Housing Cost Burden

Understanding the housing cost burden across various income bands is essential for assessing the affordability and economic strain on Jersey City residents. Housing cost burden refers to households that spend more than 30% of their income on housing, which means they have less financial flexibility and may have difficulty affording other necessities like food, transportation, and medical expenses; this is especially true for lower-income households. Cost-burdened households are also at greater risk of eviction or foreclosure. Households that spend more than 50% of their income on housing are considered to be severely cost-burdened, meaning that the difficulty to afford other basic necessities and the risk of eviction is even larger.

36,000 households with incomes below the City average of $94,000 are cost-burdened. This represents approximately 60% of the households earning below the median income. The figure underscores the high cost of living in the City and the significant disparity between income groups.

About 29,300 renter households are cost-burdened, 27,600 of which earn below the City’s median income (58% and 40% of citywide renters, respectively). The share of cost-burdened and severely burdened renters is highest among low-income households, with the share gradually decreasing with higher incomes. Approximately 14,000 (76%) of renters in the lowest income band are cost-burdened, with 11,600 (62%) of them considered severely impacted by rent. Another 7,500 (73%) of low-income renters earning between 30-50% of the City’s median are also cost-burdened, with 2,500 of those (27%) severely impacted by rent. Approximately 1,400 (21%) of households earning in the workforce band (80-100% of the City’s median) are cost-burdened, with 430 (6%) considered severely burdened. Another 1,700 (7%) renters earning at or above the City’s median income are cost-burdened, with only 75 households considered severely burdened.

When compared to renters, owners experience a higher share of severely cost-burdened households across various income bands. In total, there are about 10,600 owner households that are cost-burdened, 8,300 of which earn below the City’s median (63% and 35% of citywide owners, respectively). Approximately 2,300 (85%) of owners are cost-burdened, with 2,100 of them (79%) being severely impacted by housing costs. Another 2,350 (78%) of low-income owners earning between 30-50% of the median are cost-burdened, with 1,300 of those (42%) severely burdened by costs. Approximately 1,100 (38%) households earning in the workforce band (80-100% of the City’s median) are cost-burdened, with 315 (11%) considered severely burdened. Another 2,300 (13%) owners earning at or above the City’s median income are cost-burdened, with 160 households considered severely burdened.

Subsidized Housing

There are approximately 11,900 total units of subsidized housing in Jersey City, representing 7% of New Jersey’s statewide subsidized units. The Jersey City Housing Authority directly manages 2,250 units located in public housing and issues Housing Choice Vouchers for another 4,900 units located on privately owned buildings. There are also 78 properties, containing approximately 4,700 units built using the Low-Income Housing Tax Credit (LIHTC). These properties are distributed throughout Jersey City, with many in the McGinley Square or Communipaw neighborhoods. These units help provide housing primarily for those with less than 30% of HAMFI, ($28,200), in addition to those in the >30% to <=50% income band ($28,200 to $47,000).

Low Income Housing Tax Credit Properties

Map by RPA based on Department of Housing and Urban Development (HUD) Low Income Housing Tax Credit (LIHTC) database 2023

Other Affordable Housing

In addition to the assets and stock managed by the city’s Housing Authority, since 2019, Jersey City has been creating affordable housing units based on requirements applicable to certain private developments. While these units are deed-restricted with rents tied to specific income bands, they are not subsidized by government programs. Instead, this new stock is the result of value capture and land policies, namely resulting from individual redevelopment agreements and the city’s inclusionary zoning ordinance adopted in 2021.

The Jersey City Division of Affordable Housing (DOAH) is responsible for overseeing these units. To date, DOAH oversees 1,625 income-restricted units, 497 of which have been completed and are occupied. The remaining 1,097 units are in progress and span all stages of development, from early pre-development through the start of marketing and application periods. 60% of the total units are restricted to households with an annual income that ranges between 50%-80% of the city’s median income.

Together with demographic data, understanding housing inventory (supply) is critical baseline data for determining housing needs (demand). There is no single way to conduct a gap analysis, though when possible, it should include an analysis of how housing costs align with the incomes of residents.

To calculate Jersey City’s current and future housing needs, RPA analyzed different elements, including cost burden and housing deficiency. Approximately 38,600 (64%) of households with below-average incomes have at least one or more housing problems. These problems include incomplete kitchen or plumbing facilities, overcrowding, and households being burdened by high housing costs. Approximately 36,000 households with incomes below the city average of $94,000 are cost burdened. This figure represents approximately three times the combined stock of subsidized and income-restricted units, either through vouchers, public housing, LITHC, or deed-restricted developments.

Overcrowding is another issue in Jersey City; different households have different space needs depending on their size and composition. Multi-family homes tend to have fewer bedrooms than single-family homes, making them more likely to accommodate the needs of smaller households, such as individuals, young adults, and seniors. The majority of units (66%) in Jersey City are small, with just 1 to 2 or less bedrooms. 9,400 or 7.2% of overall units are overcrowded, and half of those (4,500) are severely overcrowded. As mentioned earlier, these trends are being compounded with the new stock coming mostly in the form of 1-bedroom apartments.

Based on the historical population and job trends projected into the future, Jersey City can anticipate adding between 10,000 and 20,000 additional households over the next decade (2022-2032). This represents potential growth that would range between 8% and 15% in a 10-year period or between 0.76% to 1.41% annually.

Current and Prospect Needs

RPA calculated current housing needs using the number of units necessary to address overcrowded households, to achieve healthy market vacancy rates (for rental 5% and homeownership 3.5%), and to permanently shelter its unhoused population. RPA then evaluated future needs, which are calculated based on potential household formation by the year 2032, as noted in the chart above, natural attrition rates (dilapidation), and projected flood loss based on 33″ of sea level increase.

Together, these indicate that Jersey City could face a housing gap ranging between 27,000 and 36,500 units by the year 2032, a figure that represents 20% to 27% of the current housing stock. According to the Jersey City Division of Planning, approximately 14,000 units are already approved or under construction, potentially reducing the gap to about half its size. However, even if all the units under the pipeline were built in the next decade, the housing deficit would still range between 13,000 and 22,500 units.

Current and Prospect Housing Needs

RPA analysis based on American Community Survey 1-Year Estimates Selected Housing and Social Characteristics Tables DP02, DP04 and McKinsey & Company housing gap methodology.

Conclusion

Jersey City has taken steps to substantially increase housing production but still faces a significant gap, due to market forces, new smaller units, and regional demand. The city cannot bear the brunt of regional housing demand on its own. Based on population size, counties in northern New Jersey have built more housing over the last decade when compared to the rest of the metro area. Municipalities in other parts of the region, like Connecticut, the Hudson Valley, and Long Island, as well as lower-density areas of New Jersey and New York City, also need to produce their share of housing, particularly around transit nodes.

There are also other measures that Jersey City can take to address its housing needs. It can work to implement additional components of its new master plan, finalized in 2022, such as promoting adaptive reuse and redevelopment of underutilized commercial and industrial properties. Also, the City can retool its existing policies over the next few years in response to community needs and housing demand. It can look at best practices for reviewing its inclusionary zoning ordinance to better align it with the growing strength of the market. By adopting lessons from cities across the country, Jersey City can also facilitate the creation of more missing middle housing. However, the growth in housing costs in Jersey City is reflective of a larger regional and national housing crisis, and the other municipalities in our tri-state region need to do their part as well to create more housing units to meet the demand.

Related Reports

531