Every three years, New York City and the United States Census Bureau conduct a study of housing condition called the Housing and Vacancy Survey. Initial results from the 2017 survey were recently released and can be found here. RPA analyzed the data and found three key takeaways that anyone who cares about affordable housing should read. This is the second in a series of three posts.

For many, New York City’s vacancy rate is the greatest explanation for housing cost. A plummeting vacancy rate reflects greater demand than supply, and therefore rising costs. A rising vacancy rate, therefore—like NYC has experienced since 2011—is cause for celebration. But as the recently published Housing and Vacancy Survey shows, increased vacancy doesn’t immediately translate into affordability for those most in need a home.

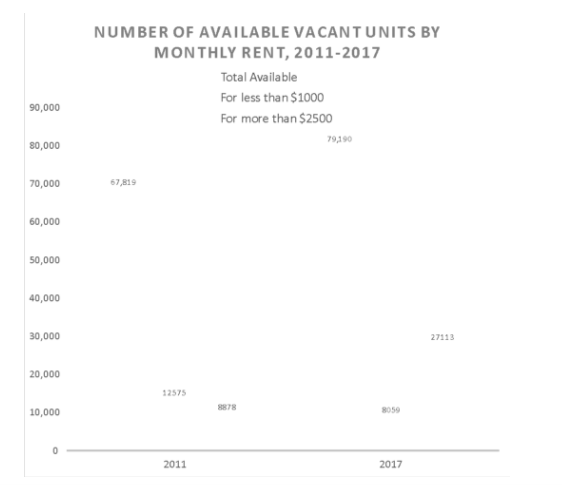

The city has about 80,000 housing units vacant and available for rent – 11,000 more than 6 years ago.* But these vacant units are asking for much more in rent. While in 2011 there were apartments vacant and available for under $1000 than there were for over $2500, in 2017 there were over three times as many apartments asking over $2,500 per month as there were asking under $1,000.

The median household income for renters in the Big Apple is about $47,000 annually. To be affordable, this household should be paying about $1,200 a month on rent. But it’s increasingly difficult to find affordable apartments for this amount of rent. Increasing numbers of people are left without affordable options – a dynamic that contributes to the exploding rates of homelessness in the city even as the number of vacant apartments grows.