Recently, the Union of Concerned Scientists released their report, “Underwater: Rising Seas, Chronic Floods, and the Implications for US Coastal Real Estate,” which analyzed the property values and socio-economic demographics of areas vulnerable to sea level rise in the coming century. Spending time in this area of research, I was not surprised to read their findings that sea level rise could devastate the personal wealth, municipal finances, and even national economy if we don’t take steps to plan for it. Even so, the numbers are staggering, and the implications are even more so. By 2045, before the end of most mortgages signed today, the report estimates that across the continental US, $136 billion of property values are at risk, with that figure growing to $1.07 trillion by the end of the century.

The report does an excellent job at looking at the different implications this massive loss in property value would have for different kinds of communities. Communities with older homeowners face losing vast amounts of generational wealth, communities with traditionally marginalized populations or high rates of poverty have fewer resources to use for adaptation, and municipalities that rely on tax revenue from high-value coastal properties will find themselves in a downward fiscal spiral. Notably, the report highlights New Jersey, along with Florida, as having the most to lose in the next 30 years, with 62,000 homes at risk of chronic flooding (meaning flooding that occurs at least 26 times per year). The report points out that, “Of New Jersey’s beach towns, 10 are projected to have at least 1,500 at-risk homes by 2045. Ocean City tops the list with more than 7,200 at-risk homes.”

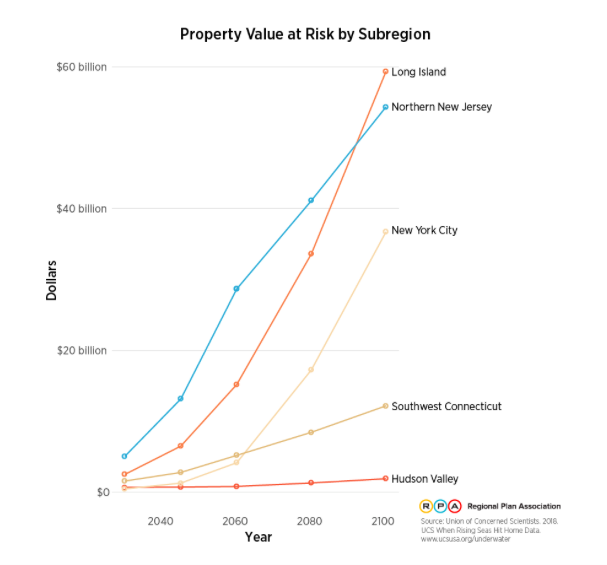

The UCS report comes with a detailed dataset, which allowed RPA to crunch the numbers for the New York Region and examine some local implications. By 2045, the 31 counties of the New York Metropolitan Region area could see over 45,000 homes at risk, valued at over $24 billion today. By 2100, that number could balloon to 285,000 homes, valued at $164 billion today. In the next few decades, Northern New Jersey (Ocean County and northward) is projected to be hit the hardest, especially in the low-lying communities around the Hackensack Meadowlands and the Jersey Shore. By the end of the century, Long Island and New York City will also be facing tens of billions of dollars in chronically flooded property.

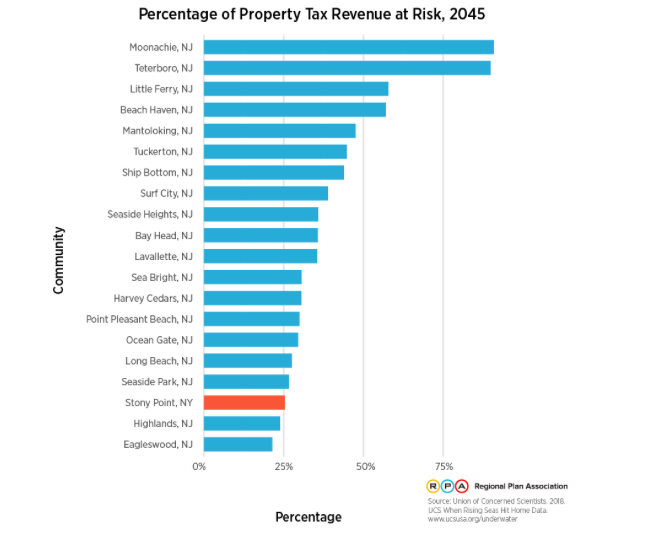

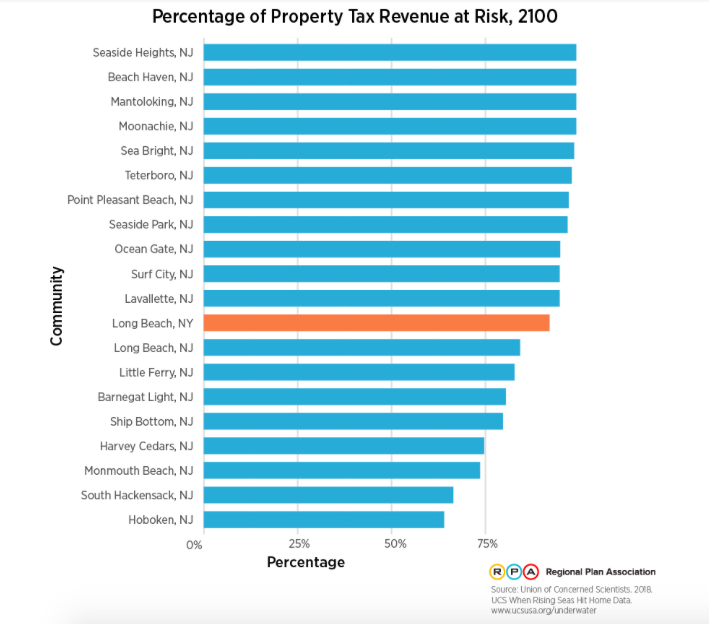

These potential losses in property are not only a blow to homeowners, but to the municipalities that count on property taxes to operate. By 2045, the region would already have 18 communities that could lose more than a quarter of their property tax revenue, and four that could lose more than half. Of the 20 municipalities that could face the highest loss of property tax revenue by 2045, all but one is in Northern New Jersey. By the end of century, 26 municipalities in the region could be facing the loss of more than half of their property tax revenue, including sizable communities like Hoboken and Secaucus in New Jersey, and Long Beach, NY.

It will be harder to act the longer we wait, as the loss of value will most likely lead to downgrading of credit, making it harder for municipalities to invest in adaptation measures. As we noted in our own similarly titled 2016 report “Under Water: How Sea Level Rise Threatens the Tri-State Region,” adapting to sea level rise requires a very different approach to adapting to storm surges, which are infrequent and temporary. Municipalities are often hesitant to engage in a conversation about planning for sea level rise, including ideas like managed retreat, for fear of political outcry and the loss of tax revenue. But as this report makes clear, the current real estate market does not accurately reflect the reality that many coastal properties will be literally underwater, even in the not too distant future. We can either plan for a way to adapt and ensure the long-term interests of the region’s coastal residents, or we can leave it up to unpredictable and volatile market forces.