As the MTA adds the finishing touches to Phase 1 of the Second Avenue Subway, ‘optimistically’ set to open by year end, many have reported rising real estate prices and development along the future route.

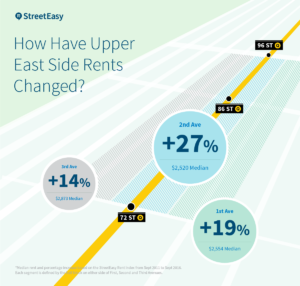

Phase 1 will extend the Q line to four new stations along Second Avenue between 63rd and 96th streets. According to Streeteasy, rents have already begun climbing in the area.

“Looking over the past five years, median rent surrounding Second Avenue has appreciated by 27 percent – almost double that of Third Avenue (14 percent) and significantly more than First Avenue (19 percent),” says Streeteasy.

Given the long and trying history of the subway’s construction, it isn’t surprising that this isn’t the first time the real estate industry has jumped aboard the Second Avenue train.

In 1929, sales along the corridor soared 50% after New York City’s board of transportation approved a budget of just under $100 million for a subway line along Second Avenue between Pine Street in Lower Manhattan and Harlem’s 125th Street, the New York Times reported at the time.

“According to the brokers, every Second Avenue owner approached by them the day of the announcement of the proposed Second Avenue subway last week either withdrew his property from the market or raised his price about 50 percent above that at which the parcel could have been bought the preceding day.”

That bull market proved premature. But with the first section of the new line set to open soon (at a cost of well over $100 million), Streeteasy’s analysis suggests that rents might continue to rise in the coming years. “Renters surrounding the new 72nd Street station and the 96th Street station could be subjected to an increase of $462 per month, based on a commute time decrease of 14 minutes to Midtown Manhattan. Those near the 86th Street station can expect a median rent increase of $330 per month, corresponding with a 10-minute decrease in commute time.”

Photo: New York Times Archive